If you receive a request to verify distribution routes, please follow these steps to submit your documents.

Step 1: Prepare the documents for submission

Please prepare required documents per seller type

■ Common standards for documents submission

– Issuance Date: Within 6 months

– File format: Recognizable images (JPG, PNG, JPEG, etc.) or PDF (other large files and Excel files cannot be submitted)

– Specify the “model name / product number / quantity” so that we can verify that the document is for the product you seek to appeal.

– Document review will only proceed if all required fields are identifiable.

– Appeal may be rejected, or additional submission may be requested if the submitted documents are insufficient.

– Submitted documents shall not be used for other purposes without your consent. All submissions are viewed as voluntary provision of information.

※ Submission of falsified documents may result in civil and criminal liability and failure to appeal may result in suspension of seller account and all listed products in accordance with Coupang’s Terms and Conditions.

Submitted documents may be provided to IPR owner to protect intellectual property rights, and the sellers are deemed to have consented to the document delivery.

■ Submission of documents based on seller type

Official importer

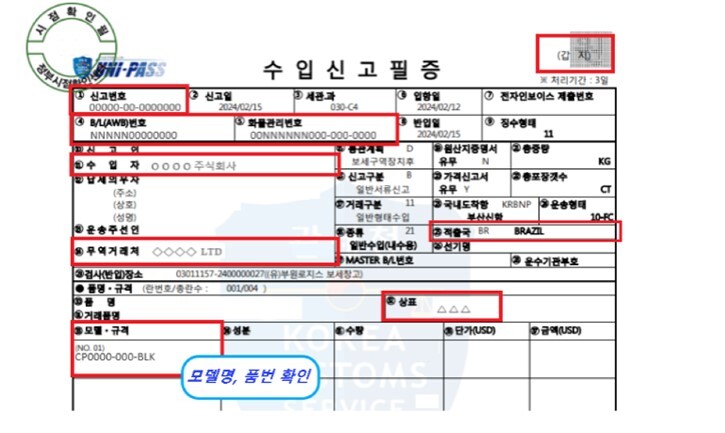

1) Import declaration certificate issued by customs office – Common(required)

– Mandatory fields: Everything except unit price, and price.

– If the product details are in the Eul page, both Gap and Eul pages must be submitted.

– Proof that the trading partner is the trademark owner or a genuine product handling company is required.

2) Documents confirming the distribution routes from the trademark owner to the seller – Choose one of the following

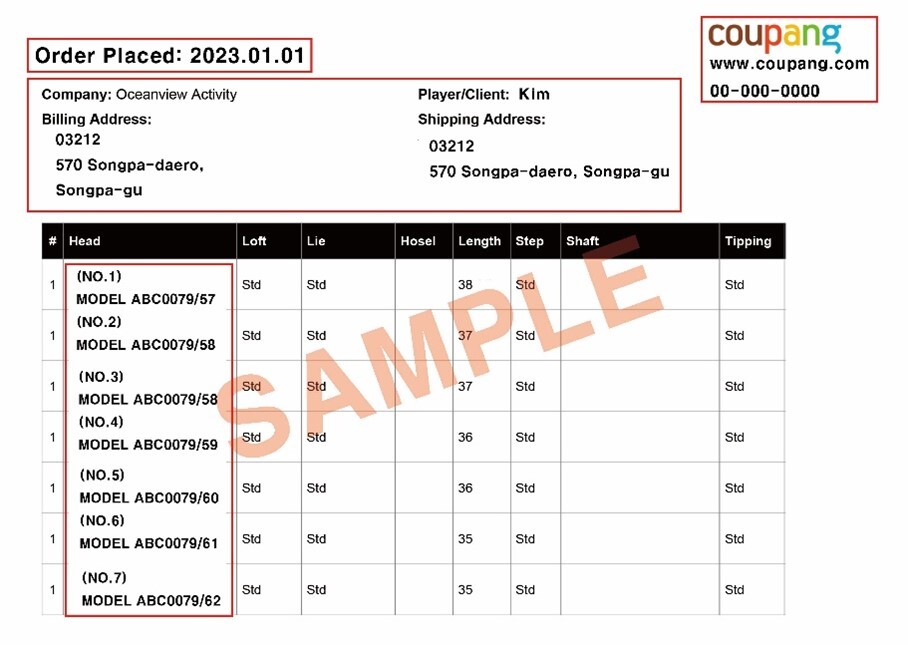

① An invoice issued by the supplier holding the trademark right

– Mandatory fields: Supplier (name of the supplier, place of purchase or website address), buyer, item, purchase date, quantity

* Documentation examples

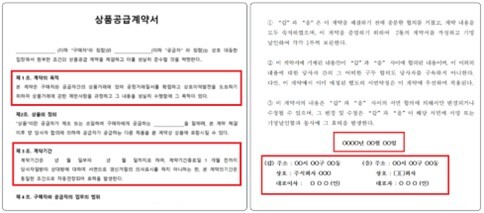

② An agreement entered with the supplier that owns a trademark for the transaction of the product

– Mandatory fields: Supplier, recipient, product transaction details (or transacted item), contract date, official seal, valid contract period

Parallel importer

1) Import declaration certificate issued by customs office – Common(required)

– Mandatory fields: Everything except unit price, and price

– If the product details are in the Eul page, both Gap and Eul pages must be submitted.

– Proof that the trading partner is the trademark owner or a genuine product handling company is required

2) Cosmetic: Quality test (authenticity test) – Common(required)

3) Non-cosmetics (clothing, accessories, etc.)

Documents confirming the distribution routes from the trademark owner to the seller

– Choose one of the following

① An invoice issued by the supplier (head office) that owns the trademark.

– Mandatory fields: Supplier (name of the supplier, place of purchase or website address), buyer, item, purchase date, quantity

② An agreement entered with the supplier (head office) that owns a trademark for the transaction of the product

– Mandatory fields: Supplier, recipient, product transaction details (or transacted item), contract date, official seal, valid contract period

③ Evidentiary information specified on the certificate of import declaration which proves that the overseas vendor (trader or supplier) sells genuine products.

– If you can’t provide first or second document, other evidence that can verify that the supplier sells authentic products

Purchasing agent

1) Transaction statement from the supplier to the seller – Common (required)

– Example: Supplier (head office or authorized dealer) → Seller A → Seller B → Seller

Submit all three of the following documents

① A’s transaction statement with the supplier

② Transaction statement between A and B

③ Transaction statement between B and the Seller

– If you source your products via online websites, please attach the order statement from the website for supplier verification.

※ Mandatory fields per transaction statement type

– Transaction statement, purchase order, outbound statement, delivery confirmation receipt : Supplier, recipient, date of transaction, item, official sign or seal of the supplier, quantity

– Tax invoices: Supplier, recipient, date of transaction, item, quantity

– Purchase receipts: Place of purchase (name of the place of purchase, address), item, purchase date, quantity

– Invoice: Supplier (name of the supplier, place of purchase or website address), buyer, item, purchase date, quantity

2) Documents confirming the distribution routes from the trademark owner to the supplier

– Choose one of the following

① An invoice issued by the supplier (head office) that owns the trademark.

– Mandatory fields: Supplier (name of the supplier, place of purchase or website address), buyer, item, purchase date, quantity

② An agreement entered with the supplier (head office) that owns a trademark for the transaction of the product

– Mandatory fields: Supplier, recipient, product transaction details (or transacted item), contract date, official seal, valid contract period

③ Documents proving that the supplier sells authentic products

– If you can’t provide first or second document, other evidence that can verify that the supplier sells authentic products

If supplied from an importer

1) The following appeal documents for the seller type of the supplier (importer & purchasing agent)

– Choose one of the three types (official importer, parallel importer, or purchasing agent ) listed above

2) Transaction statement from the importer to the seller

– Example: Importer → Seller A → Seller B → Seller

Submit all three of the following documents

① A’s transaction statement with the importer

② Transaction statement between A and B

③ Transaction statement between B and the Seller

– If you source your products via online websites, please attach the order statement from the website for supplier verification.

※ Mandatory fields per transaction statement type

– Transaction statement, purchase order, outbound statement, delivery confirmation receipt: Supplier, recipient, date of transaction, item, official sign or seal of the supplier, quantity

– Tax invoices: Supplier, recipient, date of transaction, item, quantity

– Purchase receipts: Place of purchase (name of the place of purchase, address), item, purchase date, quantity

– Invoice: Supplier (name of the supplier, place of purchase or website address), buyer, item, purchase date, quantity

Distributor & Vendor (If you purchase products from a supplier)

1) Transaction statement from the supplier to the seller – Common (required)

– Example: Supplier (head office or authorized dealer) → Seller A → Seller B → Seller

Submit all three of the following documents

① A’s transaction statement with the supplier

② Transaction statement between A and B

③ Transaction statement between B and the Seller

– If you source your products via online websites, please attach the order statement from the website for supplier verification.

※ Mandatory fields per transaction statement type

– Transaction statement, purchase order, outbound statement, delivery confirmation receipt: Supplier, recipient, date of transaction, item, official sign or seal of the supplier, quantity

– Tax invoices: Supplier, recipient, date of transaction, item, quantity

– Purchase receipts: Place of purchase (name of the place of purchase, address), item, purchase date, quantity

– Invoice: Supplier (name of the supplier, place of purchase or website address), buyer, item, purchase date, quantity

2) Documents confirming the distribution routes from the trademark owner to the supplier

– Choose one of the following

① An invoice issued by the supplier (head office) that owns the trademark.

– Mandatory fields: Supplier (name of the supplier, place of purchase or website address), buyer, item, purchase date, quantity

② An agreement entered with the supplier (head office) that owns a trademark for the transaction of the product

– Mandatory fields: Supplier, recipient, product transaction details (or transacted item), contract date, official seal, valid contract period

③ Evidentiary information specified on the import declaration certificate which proves that the overseas vendor (trader or supplier) sells genuine products.

– If you can’t provide first or second document, other evidence that can verify that the supplier sells authentic products

Step 2: How to submit

Please respond to the designated department according to the product registration stage.

If you received email requests for each brand, please reply to each email with the separately required supporting materials per brand.

1) Product registration pre-review procedure inquiry

– Korea (www.coupang.com): tns_appeals@coupang.com

– Taiwan (www.tw.coupang.com): tw_counterfeit_appeal@coupang.com

2) Product registration after-review procedure inquiry

– Korea (www.coupang.com): tns_appeals@coupang.com

– Taiwan (www.tw.coupang.com): tw_counterfeit_appeal@coupang.com

Please kindly click here to download: Guidelines on Appeal Documents for Verification of Distribution Routes